Main challenges for the Czech chemical industry in 2022

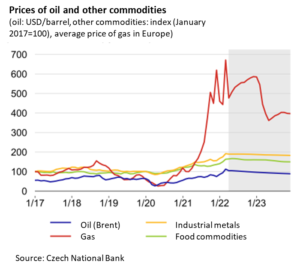

The year 2022 started with promising development of economy after 2019-2020 COVID pandemic recovery. Already year 2021 recorded results which indicated return to the industry position and role prior 2019. According Raiffeisen Bank reports, for the whole of 2021, the economy in real terms grew by 3.3%. The main factor was the recovery in domestic demand and the build-up of inventories. Nevertheless, the significant increase of the energy prices (natural gas and electricity) in the 4th quarter 2021 pushed optimistic view back. Currently, consumer spending is falling back below pre-pandemic levels due to high inflation and a deterioration in expected economic developments. The solid result in the end of 2021 provided the economy with a springboard for this year, the war in Ukraine, high inflation and a more aggressive approach of the main central banks (especially the Fed and the ECB) are changing the macroeconomic situation substantially having threat of COVID another new wave ahead of us.

The chemical industry is a very important producer of intermediates which are an integral part of the production of a wide range of end products. Polyethylene, PET and other polymers, benzene, propylene, nitric acid and epoxies – these and many others are important products, especially for the automotive, agricultural, construction, packaging and other industries. The Czech chemical industry is accounting for 13-14% of value added in the domestic manufacturing industry, directly employing almost 56 000 people (with another 100 000 in plastic and rubber processing industries and another few hundred thousands people serving those industries) is also very strongly interlinked with other sectors of the manufacturing industry and agriculture.

Manufacturing in this segment is very energy intensive. In particular, electricity, oil or natural gas are not only part of typical overhead costs or energy consumption, but oil and natural gas also represent basic input raw materials for the production of chemical products.

The chemical industry has the following challenges ahead of this year:

- Being energy intensive industry: high energy prices has impact on production cost, final price of the product followed by decrease of the demand.

- Being energy intensive industry: access to the basic energy sources is crucial to assure continuous operation. Disruption to the supply of any energy input in the chemical sector would have a cascading effect across the other sectors with which the chemical industry is intertwined.

- Being energy intensive industry: decarbonisation will mean significant transformation of the sector (even goals Fit for 55 will be achieved by continuous improvement of the operation energy intensiveness since 1990)

- Being on of the innovative industry: new challenges connected with decarbonisation are foreseen. The CCU (Carbon Capture and Utilisation) technologies will bring replacement of the fossil sources for production organic materials. Hydrogen as one of possible component for CO2 conversion is another opportunity taking into account not only green hydrogen but also hydrogen produced as by-product during chemical synthesis of desired substances.

- Regardless of macroeconomic, business and market related issues the EU continues to achieve goals defined in EGD package. Number of final legislative acts are supposed to be discussed during the Czech Presidency to EU Council in 2H 2022 such as RED III, Energy Efficiency, number of acts related to Circular Economy, CLP, REACH, CBAM, Revision of the EU Emission Trading System, including revision of the EU ETS Directive concerning aviation, maritime and CORSIA, Effort Sharing Regulation, Revision of the Regulation on the Inclusion of GHG emissions and removals from land use change and forestry (LULUCF).

Rising energy prices, combined with high pressure on energy decarbonisation and reduction of energy dependence on Russian energy supplies represent a mix of factors that have an immediate impact on the performance of many sectors of the domestic economy. Given the Czech Republic’s high level of dependence on Russian supplies of natural gas and oil, energy-intensive industries (including the chemical industry) are facing the highest risk at the moment. Given the fact that products of the chemical industry represent a significant share of the total cost of production in a number of closely related industries, it can be assumed that any rising prices of chemical inputs will also be reflected in the production of many common products or services. The performance of the chemical industry will depend not only on energy prices but also on the availability of key raw materials.

In the context of the current development of energy prices combined with the pressure to decarbonise and reduce energy dependence on Russian supplies, it is now desirable to respond flexibly and set up an appropriate government compensation schemes that will support the continuity of the long-term competitiveness of the Czech chemical industry as already applied in many other countries of EU.

Ivan Souček – director of the Association of the Chemical Industry of the Czech Republic